The deadline to turn in your 2015 taxes is quickly approaching. If your taxes are already done, I commend you. If your taxes are not yet done, however you have everything organized and ready to go, I commend you!

Each year I tell myself that I am going to do better. I will be ready for tax time. Everything will be organized. Each year I realize that I could have done things a bit better. You can start to prepare for next year’s tax preparation right now. As you prepare your taxes, make notes of what you could do better. Write down what worked well. Keep track of what you had a hard time finding. All of this can help you be more organized next year. Here are 5 things that I am trying to implement myself.

Take Advantage of Technology

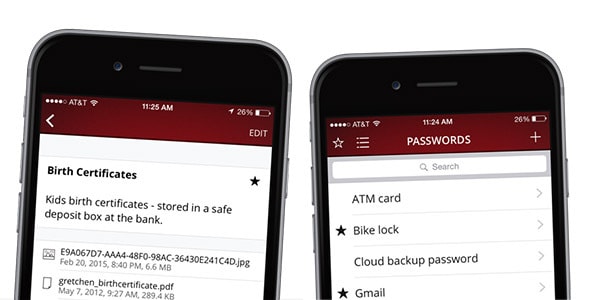

This should be a no-brainer, but you may be surprised how many have not yet come into the 21st century when it comes to doing their taxes. Instead of shuffling through piles of paperwork when filing your taxes, store relevant documents electronically. Use a scanner to scan your receipts, previous tax returns, billing statements, and other relevant documents to your computer. Store them in a safe place, like the Master Lock Vault. You can also use your smartphone camera to take a photo of the document and upload it using the Master Lock Vault app. This way even if you lose or misplace an important document you still have a copy. Having documents stored safely in the Master Lock Vault means that you can access your information from anywhere.

Secure the Hard Copy of Your Sensitive Documents

There are some things that we have to hold on to even if we do have digital copies. These documents include birth certificates, social security cards, passports, divorce papers, mortgage documents, car financing documents, and more. We may scan them to make it easier to find them during tax time. However, what do you do with the hard copies? Hopefully you lock them up.

I keep my documents in my SentrySafe. There is plenty of room for documents, small electronics, and anything else that I want to securely lock up. It’s a great idea to keep important documents like these locked up at all times.

And if you are going on vacation you can lock up small electronics, jewelry, and other valuables. I do wish that it would fit a 13” laptop, but it does not quite fit. However, other gadgets like our tablets, my Microsoft Surface 3, smartphones, and cameras fit just fine. It’s great to be able to lock these things up while going away for an extended period, or while hosting a party.

Keep All of Your Receipts in One Place

Keeping up with receipts is key in preparing your taxes. You have to keep track of business purchases, parking fees, and other expenses that you can deduct. I have a pretty messy drawer in my office where I come home and stuff all receipts and check stubs. I must do better!

However, I try to make most of my business purchases online. This makes it easy to access my order history when I prepare my taxes. I pull up my order history on Amazon, eBay, Staples, or other sites that I used throughout the year and make a note of business related purchases in a spreadsheet. Once they are in a spreadsheet I can quickly come up with a total. This is great way to save paper.

Keep Track of Business Purchases

As mentioned above, I keep track of my business purchases. Since I run a home-based business, a great deal of my tax prep depends on putting money into my business. I’m constantly upgrading cameras, smartphones, and printers. I also buy a fair amount of tech accessories and office supplies. These things are claimed on my taxes as business expenses. Even smaller purchases like ink pens and printer ink add up. Keep track of all of these purchases throughout the year. And if you feel that you did not spend enough, make one more major purchase before the end of the year. I do this at the end of every year! This is a great time to get a good deal. And getting a new gadget always feels good. 🙂

Get Started Early

I am a horrible procrastinator sometimes. When it comes time to do taxes I usually wait until I am ready to get started to collect everything, spread receipts and papers all over my desk, and start crunching numbers. It does not have to be this way. Consider using accounting software to categorize your income and purchases throughout the year. Instead of stuffing all receipts in a drawer like me, keep business receipts separate. As you get receipts, etc. store them all in safe place. Once a week take a little time to scan them all in and categorize them. When tax time rolls around you will be so happy that you did.

Encourage your clients to pay you via electronic means rather than cash. This way receipts be automated, or can be generated quickly. If most of your monetary business dealings are handled electronically, it will be easy to just run reports at tax time. This means less paperwork for you.

These are just a few of the things that come to mind when I think about how I could be doing a better job of dealing with my taxes.

What are some of your tips for keeping things organized for tax time?

Disclosure: This post is sponsored by Master Lock. All opinions are my own.

Leave a Reply